It's going to be no surprise to most Oregon residents that simply finding an affordable space to rent or buy is becoming more and more difficult, and the statistics don't lie.

A recent 2024 study shows that on average, people in Oregon are shelling out about $42,843 each year for housing, which eats up 54% of the average household's take-home pay. Washington's stats are even more alarming, with our northern neighboring state coming in at number four on the list.

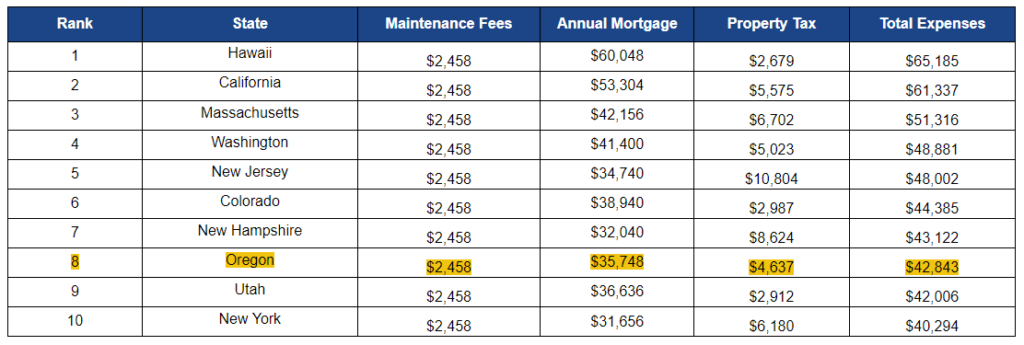

Cinch Home Services, a home warranty company, recently did a study to see which states are hit hardest by high housing costs. They looked at things like property taxes, mortgage payments, and maintenance fees for a typical home in each state. Their findings showed which states have the least financial wiggle room for these expenses.

A spokesperson from Cinch had this to say:

"The dream of owning a home is a cornerstone of the American identity. However, for many, that dream is fading. In places like Hawaii, skyrocketing housing costs devour over 75% of a paycheck, forcing residents to choose between a roof and basic necessities. This isn't an isolated issue – it's a national problem.”

“Addressing this problem requires a multi-pronged approach. We must explore increasing the housing supply to meet demand while considering rental assistance programs and initiatives that make homeownership attainable for low- and middle-income families."

In Oregon, homeowners are paying 37% more on housing compared to the national average. With the median home price around $498,500, annual mortgage payments come to about $35,700. Property taxes, at a rate of 0.93%, add another $4,600. When you factor in annual maintenance costs, the total yearly bill reaches $42,843.

Comparatively, Hawaii tops the list with the highest housing costs. Even though the average annual take-home pay in Hawaii is $86,376, housing expenses hit $65,185, which is over 75% of their income. This is due to high mortgage payments of $60,048 and maintenance costs that are in line with the national average of $2,458. However, Hawaii has the lowest property tax rate in the country at 0.32%.

Here’s how the states with the highest housing expenses rank:

- Hawaii - Total annual expenses: $65,185

- California - Total annual expenses: $61,337

- Massachusetts - Total annual expenses: $51,316

- Washington - Total annual expenses: $48,881

- New Jersey - Total annual expenses: $48,002

- Colorado - Total annual expenses: $44,385

- New Hampshire - Total annual expenses: $43,122

- Oregon - Total annual expenses: $42,843

- Utah - Total annual expenses: $42,006

- New York - Total annual expenses: $40,294

California comes in second, with residents paying an average of $61,337 a year, which is 71.8% of their take-home pay. This is largely due to the high median home price of $743,362, leading to $53,304 in yearly mortgage payments.

Massachusetts is in third place. Despite having the highest average household income in the country at $147,219, residents still spend 51.9% of their take-home pay on housing, with property taxes averaging nearly $7,000 annually.

Washington ranks fourth, with a median home mortgage costing $41,400 annually, 38.8% above the national average. Total housing costs there reach 54.1% of take-home pay.

New Jersey is close behind, with annual housing costs hitting $48,000, which is 50.2% of their take-home pay.

These high housing costs are putting a significant strain on many residents, making it tough to keep up with the rising expenses.

On the flip side, the ten US states with the lowest housing costs are mostly in the Midwest and South: West Virginia, Mississippi, Louisiana, Arkansas, Oklahoma, Kentucky, Missouri, Iowa, Kansas, and Illinois.