News

Fire Erupts at Timberline Lodge on Mount Hood

GOVERNMENT CAMP, Ore. — A fire was reported at Timberline Lodge in Government Camp on Thursday night at approximately 9:26 p.m.

Food & Drink

In-N-Out Burger to Open in Beaverton, Less Than 15 Minutes From Downtown Portland

Exciting news for everyone who has been patiently waiting for In-N-Out to come to the Portland area! In-N-Out Burger is set to...

News

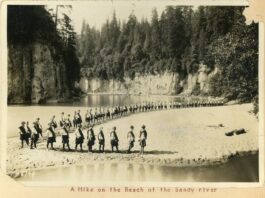

Camp Namanu in Oregon Officially Listed as a Historic Place After 100 Years

Recently, Oregon's beloved Camp Namanu, operational since 1924, was formally acknowledged and added to the National Register of Historic Places. This recognition...

GOVERNMENT CAMP, Ore. — A fire was reported at Timberline Lodge in Government Camp on Thursday night at approximately 9:26 p.m.

Exciting news for everyone who has been patiently waiting for In-N-Out to come to the Portland area! In-N-Out Burger is set to...

Recently, Oregon's beloved Camp Namanu, operational since 1924, was formally acknowledged and added to the National Register of Historic Places. This recognition...

Looking for a cozy spot for a romantic getaway? Or maybe you need to head to Philomath or Corvallis for work or...

Hidden like a treasure among the verdant landscape of Oregon, just ten minutes east of Sandy on Highway 26, the Ivy Bear...

Are you looking for an escape from the constant commotion of city life? Do you love the peace and tranquility of being...

I grew up in Eugene, Oregon, and although my experiences are mostly limited to this region, I truly believe I couldn't have...

In 2023, Oregon's gray wolf population growth stalled, marking the first year without an increase since their reestablishment in the state, according...

Hiding in plain sight on the side of Highway 126 is a little pizza spot you've probably passed half a dozen times...

In Sherwood, Oregon, a high school track and field event became the center of a heated debate after a transgender athlete, Aayden...